Mike Cheng

PhD Candidate in Economics

Georgetown University

I am a fourth year Economics PhD candidate with research interests in international trade and industrial organization. My research focuses on the intersection of FDI, market power, and supply chain structure. I welcome coauthorship opportunities.

Education

Georgetown University

PhD Candidate in Economics

University of Chicago, Harris School of Public Policy

Master of Arts in Public Policy

Certificate of Research Methods and Certificate of Financial Policy

Recipient of Harris Merit Scholarship

June 2021

Carnegie Mellon University

Bachelor of Arts in Behavioral Economics, Policy and Organization

Minor in International Relations and Politics and Economics

Graduated with University Honor

Member of Omicron Delta Epsilon Honor Society

May 2019

Publication

Chapter 6: Foreign Direct Investment, Trade Finance and Global Value Chain Integration

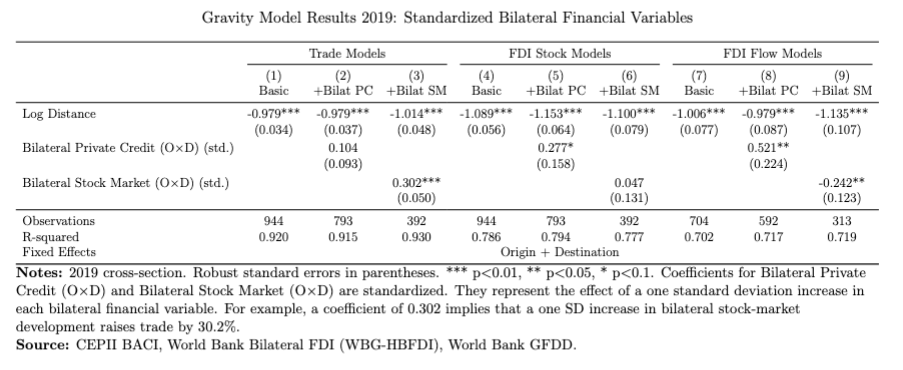

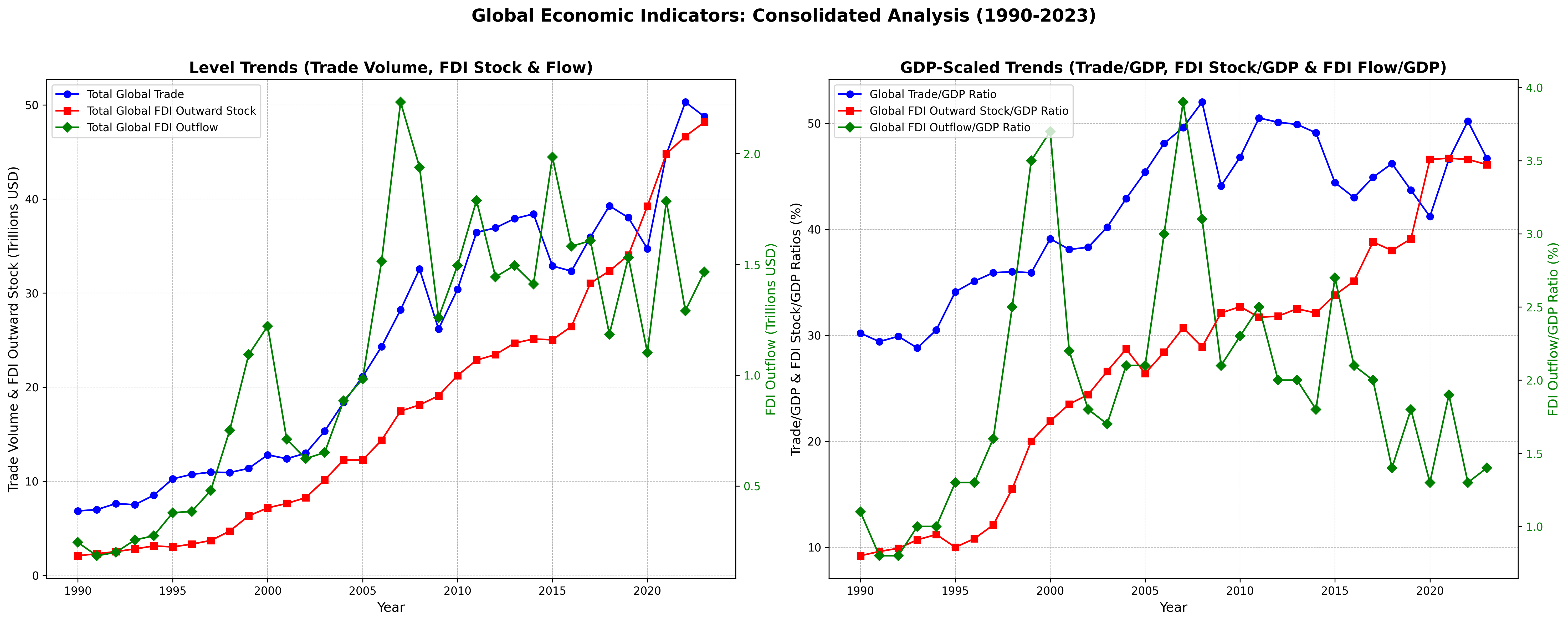

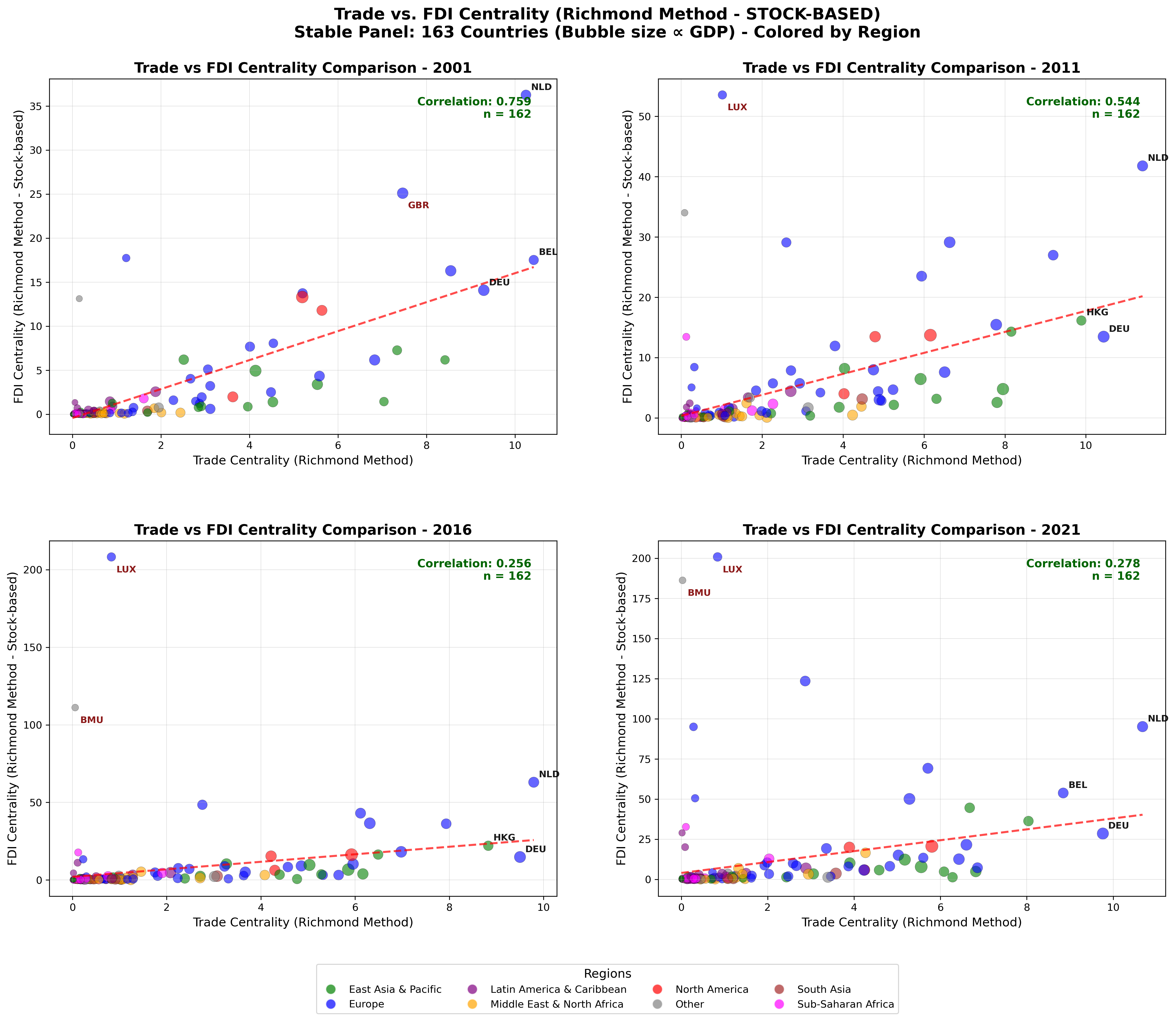

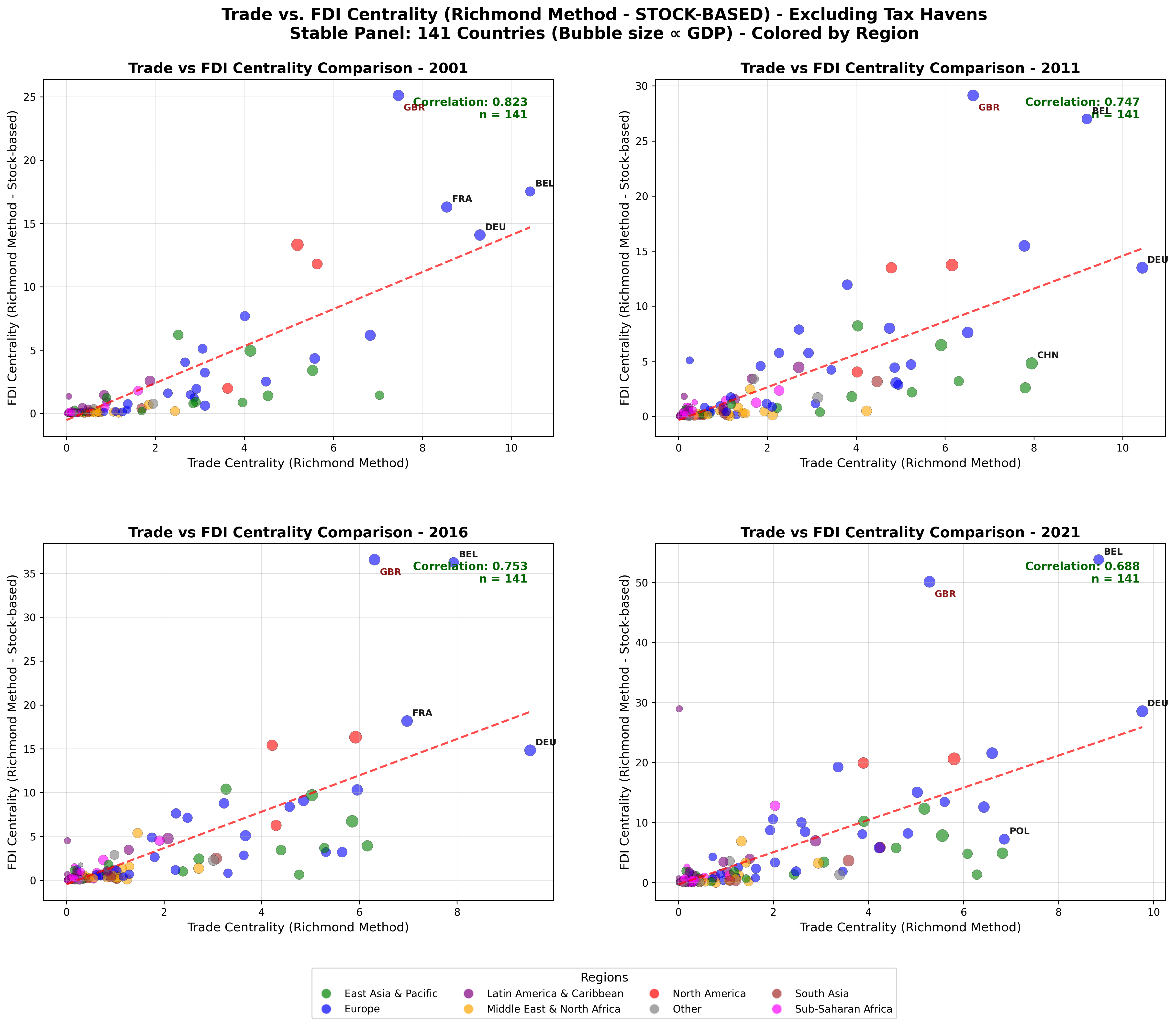

This chapter reconceptualizes the financial architecture of Global Value Chains (GVCs), arguing that Foreign Direct Investment (FDI) provides the structural foundation while Trade and Supply Chain Finance (TF/SCF) ensures operational fluidity. Using a gravity framework, we first show that trade and FDI have distinct financial underpinnings: trade is more sensitive to bilateral stock market development, while FDI responds more to private credit depth. Next, we apply network analysis to distinguish productive investment from "phantom FDI," revealing a resilient "real economy" network where trade and FDI centrality remain highly correlated once tax havens are excluded. Finally, our econometric analysis provides evidence of "GVC assimilation," showing that FDI fosters convergence in the use of capital inputs between source and host countries—a key channel for capital-embodied technology transfer—but not in intermediate inputs. We conclude that deep GVC integration requires a dual policy strategy that supports both long-term investment and the short-term financing that allows local firms to connect and upgrade within these global production networks.

Key Findings

Gravity Model Results 2019: Standardized Bilateral Financial Variables

Global Economic Indicators: Consolidated Analysis (1990-2023)

Trade vs. FDI Centrality (Richmond Method - Stock-Based) - Stable Panel: 163 Countries

Trade vs. FDI Centrality (Richmond Method - Stock-Based) - Excluding Tax Havens: 141 Countries

Working Papers

Going Overseas: FDI Decisions and Supply Chain Integration

This paper investigates how Chinese outbound foreign direct investment (FDI) influences the integration of host countries into China’s global supply network, addressing a key question: Does Chinese FDI deepen supply chain linkages between host economies and China? To answer this, I develop a comprehensive empirical–theoretical framework leveraging a novel dataset that uniquely combines detailed Chinese FDI records, firm-to-firm international trade data, and input–output industry linkages. Empirically, I first provide indirect evidence through sector-level analysis demonstrating significant downstream impacts—Chinese investments in downstream sectors are associated with notable increases in the market share of Chinese firms operating in related upstream industries. Additionally, I uncover evidence of upstream effects, showing that Chinese investments in sectors with high upstreamness correlate with increased host-country exports back to China, particularly benefiting lower-income economies.

Compute as Capital, Latency as Tariff: How Digital Endowments and Frictions Shape Specialization in the Age of AI

We conceptualize compute—proxied by cloud GPU price-per-performance and proximity to cloud regions—as a price-observable, partly tradable factor, and treat latency and data-localization as bilateral iceberg costs for AI inference services. A unified Ricardian–HO framework with a compute–skill nest links exporter compute endowments and route-specific frictions to specialization in digitally deliverable services and, over time, to high-tech merchandise. Empirically, we assemble a quarterly Compute Price Index from posted cloud prices mapped to MLPerf benchmarks, a bilateral latency matrix validated with public active-measurement data and perturbed by submarine-cable shocks, and digital-trade restrictiveness indices. Using PPML gravity with exporter- and importer-time fixed effects, we identify effects via staggered cloud-region openings (access/latency instruments) and energy-price shifters (compute costs). We test whether cheaper/nearer compute boosts digital exports, whether latency and data rules interact multiplicatively, and whether sustained compute improvements raise high-tech export shares. Policy counterfactuals quantify the trade and welfare impacts of sovereign-cloud mandates, infrastructure rollouts, and energy shocks—showing how "compute as capital" and "latency as tariff" jointly determine who captures the gains from AI.

Project

From Autoregression to Trade Insight: A Scalable Forecasting Framework for Bilateral Flows

Competition Context: This project was developed for the AI for Trade Challenge, a data science competition focused on predicting bilateral trade flows. The challenge tasks participants with forecasting monthly trade values at a highly disaggregated product level, providing valuable insights for trade policy and economic analysis.

This paper introduces a forecasting framework developed for the AI for Trade Challenge, targeting monthly bilateral trade flows at a high level of product granularity. We construct a model that predicts October 2025 trade values between the United States, China, and their top trading partners at the HS4-product level using a combination of machine learning and time-series baselines. The model incorporates over twenty macroeconomic, financial, and commodity indicators as exogenous drivers. Using LightGBM with a Tweedie loss function, the model handles the zero-inflated, heavytailed nature of trade data. Internal cross-validation indicates promising performance, with sMAPE of 43.22% and a total predicted trade volume of $156.4 billion. We discuss the model's construction, performance, and broader implications for forecasting disaggregated trade flows.

Teaching

Teaching Assistant

- Intermediate Macro Econ (Professor Dan Cao, Spring 2025)

- Public Sector Economics (Professor David Burk, Fall 2024)

- International Trade (Professor Pinar Cebi Wilber, Spring 2024)

- Intermediate Microeconomics (Professor Marius Schwartz, Fall 2023)

Curriculum Vitae

You can download my CV here.

Contact

Email: zc156@georgetown.edu

Phone: (617) 669-7091

Address: Department of Economics

Georgetown University

Washington, DC